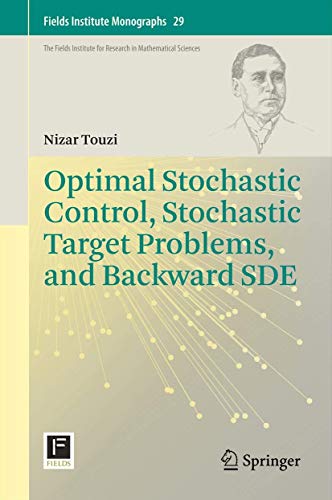

Optimal Stochastic Control, Stochastic Target Problems, and Backward SDE: 29 (Fields Institute Monographs)

Optimal Stochastic Control, Stochastic Target Problems, and Backward SDE: 29 (Fields Institute Monographs) is backordered and will ship as soon as it is back in stock.

Couldn't load pickup availability

Genuine Products Guarantee

Genuine Products Guarantee

We guarantee 100% genuine products, and if proven otherwise, we will compensate you with 10 times the product's cost.

Delivery and Shipping

Delivery and Shipping

Products are generally ready for dispatch within 1 day and typically reach you in 3 to 5 days.

Book Details:

-

Publisher: Springer

-

Author: Nizar Touzi

-

Language: English

-

Binding: Paperback

-

ISBN: 9781493900428

-

Pages: 214

-

Release Date: 15-10-2014

-

Format: Import

About The Book:

"Stochastic Control and Applications to Finance" by Nizar Touzi presents recent advancements in stochastic control theory with direct applications to financial mathematics. This specialized work is essential for researchers, students, and practitioners who are looking to explore the interplay between stochastic processes and financial modeling.

The book provides a comprehensive treatment of stochastic control problems from the perspective of the weak dynamic programming principle. Special attention is paid to regularity issues, particularly the behavior of the value function near the boundary, an area that is critical in practical applications.

Touzi takes a methodical approach to the subject, starting with an overview of the main tools from viscosity solutions, which resolve key regularity problems that often arise in stochastic control. He then extends the theory to a class of stochastic target problems, which significantly broadens traditional stochastic control applications, particularly in financial contexts.

A key part of the book deals with the theory of viscosity solutions and how it aids in deriving the dynamic programming equation, which is crucial for understanding the infinitesimal counterpart of geometric dynamic programming equations. These developments have been greatly influenced by real-world financial issues such as illiquidity modeling and quantile hedging.

The third part of the book provides an insightful overview of Backward Stochastic Differential Equations (BSDEs), as well as their extensions to the quadratic case, opening up new avenues in the analysis and optimization of financial systems.

This book is a must-have resource for anyone looking to deepen their understanding of stochastic control theory and its application to financial mathematics, especially those interested in dynamic programming, backward stochastic differential equations, and quantile hedging.